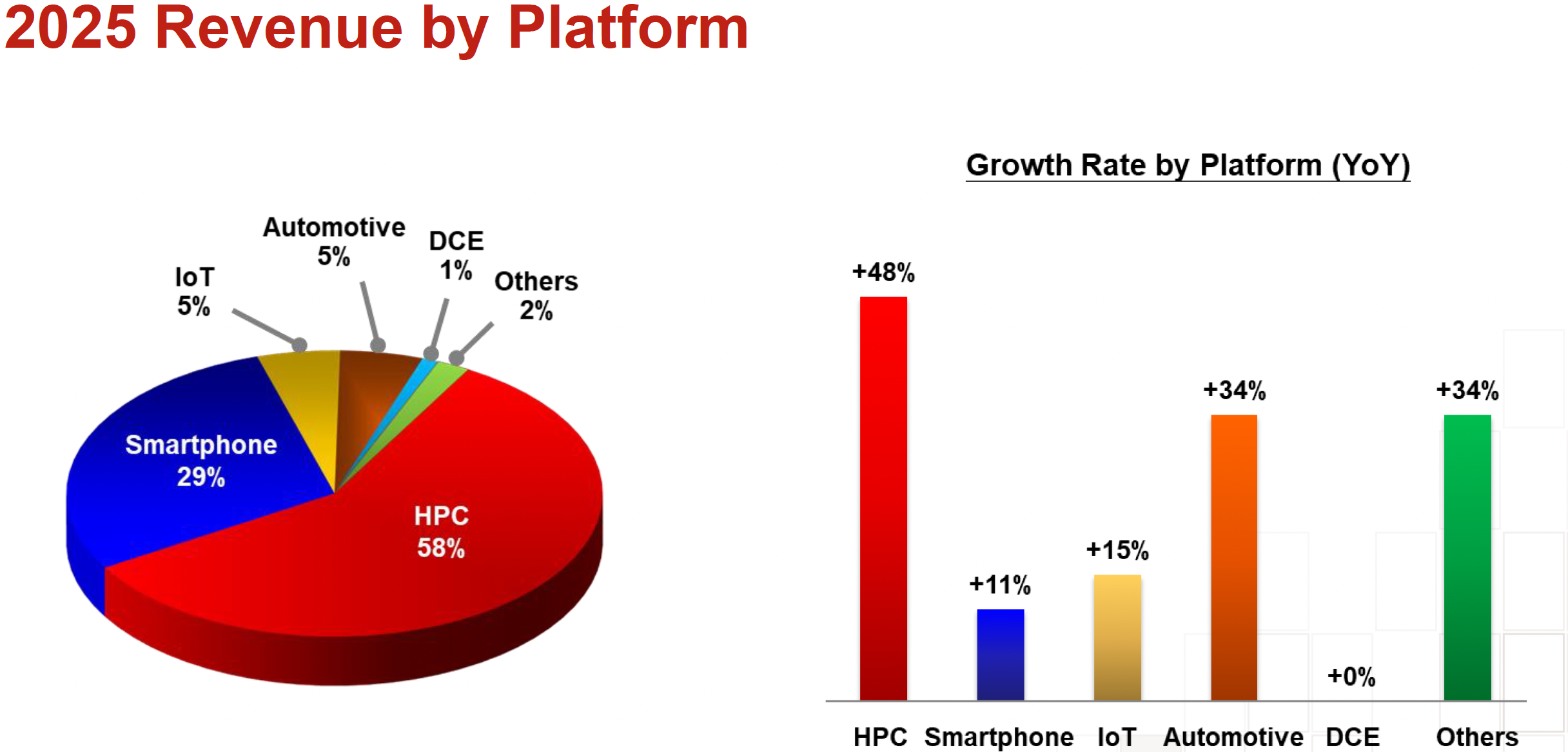

TSMC on Thursday published its financial results for 2025, posting an annual revenue of $122.42 billion for the first time in its history. TSMC's extraordinary results were driven by sales of AI and HPC processors — which accounted for 58% of the company's 2025 revenue — as well as the company's growing market share. To support rising demand for its services as well as tooling of advanced fabs in Taiwan and Arizona, TSMC has committed to increasing its capital expenditure (CapEx) to $52 billion - $56 billion in 2026, which is more than Intel and Samsung spent in 2025 combined. When asked about the prospect of an AI bubble, TSMC's CEO warned the company was "very nervous," hence the hefty CapEx spend. He further warned, "If we did not do it carefully, that would be a disaster for TSMC for sure."

An AI bubble? What AI bubble?

More specifically, TSMC intends to spend about 10% of its CapEx on specialty technologies, between 10% and 20% of CapEx on advanced packaging, and around 70% will be used to buy sophisticated equipment (both for existing and new fabs) and build new advanced logic fabs. While TSMC certainly understands the risks of the so-called AI bubble, given the lead times for new fabs (about three years) and advanced fab tools, it does not seem to expect that bubble to pop in the coming years, at least based on C.C. Wei's answer to one of the questions.

"You essentially try to ask us whether the AI demand is real or not," C.C. Wei, chief executive of TSMC, asked rhetorically during the company's earnings conference. "I am also very nervous about it. You bet, because we have to invest about $52 billion to $56 billion for the CapEx. If we did not do it carefully, and that would be big disaster to TSMC for sure. So, I spent a lot of time in the last three – four months talking to my customer and my customer's customer, as I want to make sure that my customer's demand is real. So, I talked to those cloud service providers, all of them. […] I am quite satisfied with the answer. Actually, they showed me the evidence that the AI really helps their business. So, they grow their business successfully and healthily in their financial return. I also double checked their financial status: they are very rich […] much better than TSMC."

Indeed, out of $122.42 billion that TSMC earned in 2025, AI and HPC* processors accounted for 58%, or roughly $71 billion, a 48% year-over-year growth, and the highest result for these categories in years.

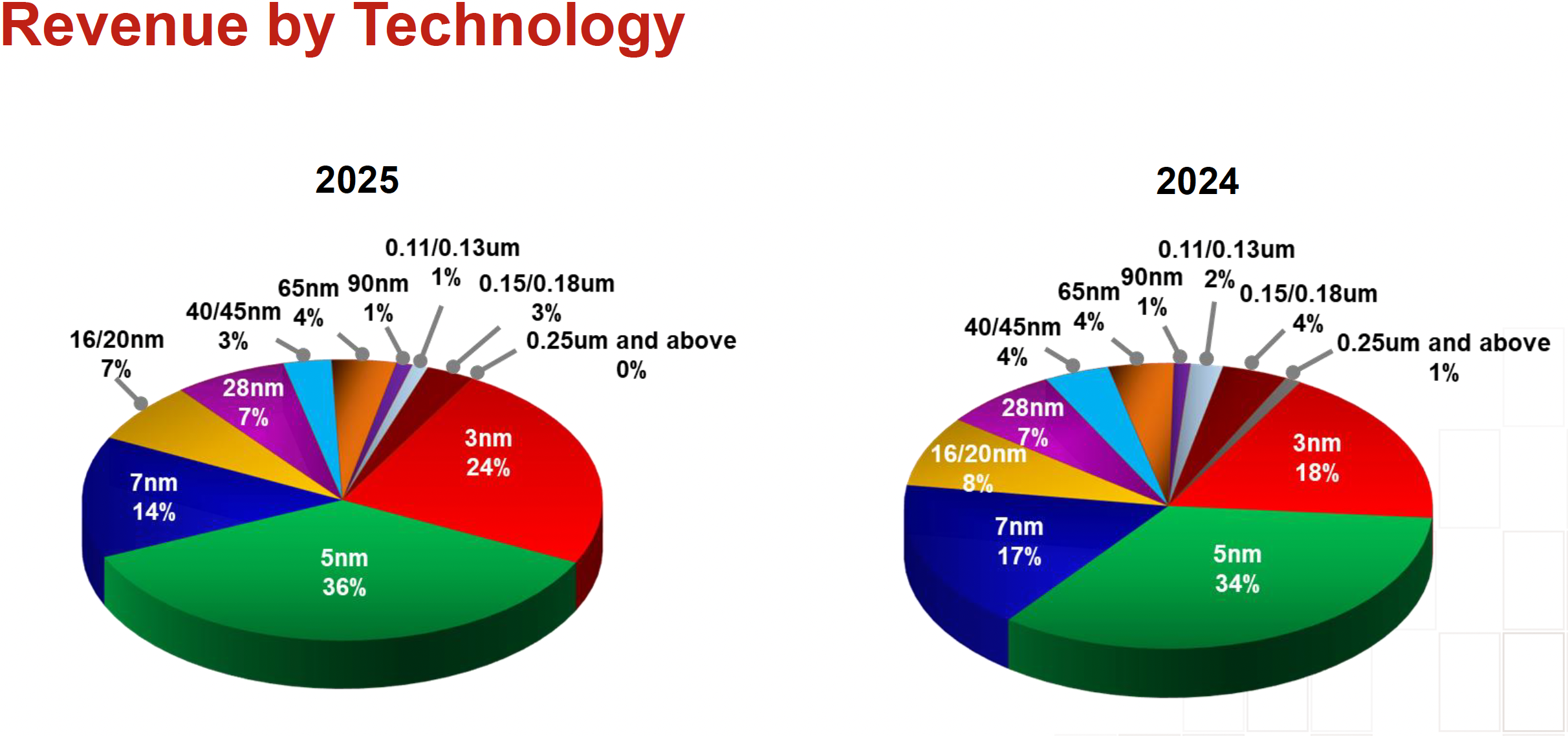

From a node perspective, advanced process technologies accounted for 74% of the foundry's wafer revenue, with 3nm accounting for 24%, 5nm responsible for 36%, and 7nm liable for 14%.

More advanced fab modules to support demand

TSMC began to ramp up production of chips using its N2 (2nm-class) fabrication process at Fab 20 and Fab 22 in Taiwan in the fourth quarter, with more N2 and A16-capable fab modules coming online in the foreseeable future to support unprecedented demand for leading-edge nodes over the coming years.

As for the $165 billion Arizona Fab 21 campus buildout, C.C. Wei confirmed that Fab 21 phase 2 shell has been constructed, with fab tool installation set to begin in 2026 and first products coming from the fab in the second half of 2027. The Fab 21 phase 3 building is in progress, and TSMC has already obtained permits for Fab 21 phase 4 and the advanced packaging facility in Arizona. Finally, the company has acquired another plot of land to support Fab 21 expansion and "provide more flexibility in response to the very strong multiyear AI-related demand."

"Our plan will enable TSMC to scale up an independent giga-fab cluster in Arizona to support the need of our leading-edge customers in smartphone, AI, and HPC applications," Wei said.

Intel Foundry? Not a competitor any time soon

Pouring in $165 billion in its Fab 21 campus near Phoenix, Arizona, is a tremendous business project full of risks and uncertainties. Competition from other players — such as Intel Foundry and Samsung Foundry — is among the risks for TSMC. Furthermore, with the U.S. government, Nvidia, and Softbank investing in Intel, the company's reputation as a formidable competitor is growing stronger in the eyes of industry observers. However, TSMC chief executive C.C. Wei does not expect Intel Foundry to actually become a competitor that might slow his company's growth any time soon.

Without any doubt, Intel's ramping up of Panther Lake on its leading-edge 18A (1.8nm-class) process technology is an impressive achievement. However, for now, only Intel can build chips on 18A. By contrast, TSMC has multiple alpha customers with its N2 node, who have worked on their chips for years. The message that C.C. Wei sent is that leading-edge foundry competition is constrained by time, not by capital. He said, "it is not money to help you to compete," pushing back against the idea that government support or large investments can instantly create competitiveness at advanced nodes.

C.C. Wei recalled that it takes between two and three years for customers to learn how to design a complex chip on a new process and work closely with the chipmaker on DTCO (design technology co-optimization), followed by another one or two years to qualify and ramp it into high-volume production.

"Today's [leading-edge] technology is so complicated [that] once you want to design [a chip], it takes two to three years to fully utilize that technology," said Wei. "After two to three years of preparation, you can design your product. Once you get your product being approved, it takes another one to two years to ramp it up."

That means even if customers like Apple or Nvidia chose today to use Intel Foundry at the leading-edge, any meaningful commercial impact would likely appear around 2028 – 2030 (both for 18A and 14A), not in the near term. Furthermore, porting a leading-edge design from one foundry to another is an extremely complex task since things like standard-cell libraries, third-party IP blocks, power-delivery techniques, timings, and yield learnings are tightly coupled to a specific manufacturing process, which means that porting equals designing and validating from scratch, something that takes years, costs millions, and there is no guarantee of success.

"So, we have a competitor, no doubt about it, that is a formidable competitor," Wei added. "But first, it takes time. Two, we do not underestimate their progress, but are we afraid of it? For 30-some years, we are always in a competition with our competitors, so no, we have confidence to keep our business grow as we estimate."

Interestingly, the timeline presented by Wei mirrors TSMC's own outlook, where the next two years are about squeezing more output from existing fabs by ramping up N2-capable capacity in Taiwan and by converting N5-capable fabs to N3-capable fabs, while several all-new fabs are set to come online only in 2028 – 2029.

Throughout its history, TSMC has had impressive rivals like IBM, UMC, and Samsung, which TSMC has managed to leave behind. But the complexity of the semiconductor industry in general and leading-edge process technologies in particular is so high today that matching TSMC is not about achieving similar transistor performance, power, and density, but about building an entire development ecosystem that spans from defining a new node with a customer (or customers in case of N2 and A16) and partners to helping them design and optimize their chip and then assisting them with volume ramp it five or six years down the road.

The bottom line about today's leading-edge nodes is that this is a long-term commitment that takes time and a lot of money, and no short-term or mid-term investments from reputable entities can change that.

Good results can only get better

TSMC earned $33.73 billion in revenue for the fourth quarter of 2025, up 20.5% year-over-year, the company's highest quarter revenue ever. The company's gross margin reached 62.3% (up from 59% in Q4 2024) amid the building of multiple manufacturing facilities and ramping up production on TSMC's all-new N2 fabrication process, which typically hurts margins significantly. The foundry's net income reached around $16.012 billion, which also happens to be a record. As for the results for the whole year, TSMC earned $122.42 billion in revenue and $55.133 billion in net income.

It is noteworthy that despite posting the company's best quarter results ever, TSMC's management is confident that the company will earn between $34.6 billion and $35.8 billion in the first quarter, which is traditionally a slow quarter for electronics in general and microelectronics specifically.

*HPC is a vague term TSMC uses to describe everything from laptop CPUs to high-end AI accelerators.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

.png)

2 hours ago

1

2 hours ago

1

English (US) ·

English (US) ·