In brief

- Spot Bitcoin and Ethereum ETFs shed a combined $996 million on Wednesday.

- Investors’ retreat came amid a twist in President Donald Trump’s bid for Greenland.

- Bitcoin is behaving like a risk-on asset, according to an analyst.

Investors pulled nearly $1 billion from exchange-traded funds tracking the spot price of Bitcoin and Ethereum on Wednesday, seeking refuge from cryptocurrency exposure as U.S. President Donald Trump struck a new chord in his approach to acquiring Greenland.

The president said on his Truth Social platform on Wednesday afternoon that he had “a framework of a deal” regarding the Danish territory, as well as the Arctic region, following talks with NATO secretary Mark Rutte.

Along those lines, Trump abruptly backed away from threats to impose tariffs on European nations that stood in opposition of his bid for the semi-autonomous island. Not long before, he also ruled out the use of force during his address in Davos, Switzerland. Markets rebounded following his comments after falling into the red Tuesday amid tariff uncertainty.

On Thursday, Danish Prime Minister Mette Frederiksen signaled that she was receptive to Trump’s about-face, but she said in a statement that “we cannot negotiate our sovereignty,” pushing back against Trump’s assertion that the U.S. must own the territory for national security.

The developments had all the making of a “TACO” situation, short for “Trump Always Chickens Out.” The acronym was coined last year in reference to Trump’s habit of announcing massive tariffs as a pressure tactic, only to reverse course once global markets begin to dip.

Investors yanked $709 million for spot Bitcoin ETFs in the U.S. on Wednesday, the biggest single-day bleed since Nov. 20, according to CoinGlass. Meanwhile, spot Ethereum ETFs shed $287 million. However, the snapshot does not include flows from products listed in Europe.

In a Thursday note, Jasper De Maere, a desk strategist at crypto market maker Wintermute, said Trump’s pivot removed “some immediate geopolitical overhang that was driving the earlier selloff,” but “macro risk remains elevated” despite any stabilization in Bitcoin’s price.

Bitcoin and Ethereum dipped indeed. Recently changing hands around $89,000, Bitcoin was down 7.5% over the past week, while Ethereum had fallen 12% to $2,950 over that same period of time, according to CoinGecko. Last week, they notched their highest prices in more than a month.

“Bitcoin is acting like a high-beta and risk-on asset, trading very similarly to equities,” Carlos Guzman, a research analyst at crypto trading firm GSR, told Decrypt. “Bitcoin is not acting as a store of value. It’s not yet digital gold in investors’ minds.”

CoinShares Head of Research James Butterfill noted in a recent report that sentiment toward digital asset investment products soured last Friday, as diplomatic tensions flared. Still, the products generated $113 million in net inflows last week among investors in Europe.

Analysts at investment bank Compass Point have linked Bitcoin’s recent route to jitters among short-term holders, who are typically more sensitive to price swings. They identified the $98,000 mark for Bitcoin as a key threshold for rallies in that respect.

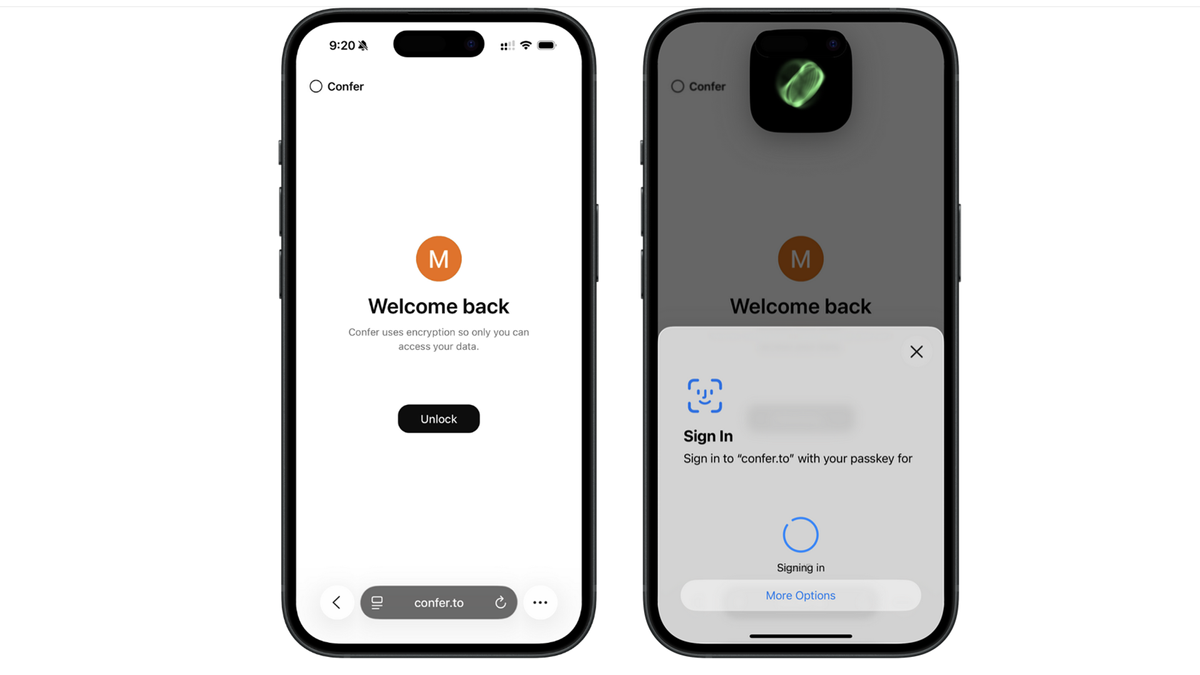

What’s more, hopes regarding the passage of a crypto market structure bill have been dashed by Coinbase, which withdrew its support from the bill. The White House still expects the bill to pass, which Wintermute’s Da Maere described as a short-term catalyst.

“Seeing participants pull out their support of that bill, I think that just added to the pessimism this week,” GSR’s Guzman said. “There was a lot of optimism.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

.png)

2 hours ago

1

2 hours ago

1

English (US) ·

English (US) ·