TLDR

- Arista Networks stock rose 5.3% on Tuesday to close at $129.93

- Piper Sandler upgraded the stock citing improved visibility in AI and enterprise spending

- New partnership with Fortinet focuses on secure AI data center solutions

- Company expanding 400G and 800G Ethernet switches for AI infrastructure

- Earnings expected around February 17 with focus on AI-driven data center demand

Arista Networks shares climbed 5.3% on Tuesday, closing at $129.93. The stock held steady near that level heading into Wednesday’s session.

The rally came after Piper Sandler upgraded Arista to a more positive rating. The firm pointed to better visibility in enterprise IT spending and demand from hyperscale and AI-focused customers.

The upgrade wasn’t the only catalyst. Fortinet announced a partnership with Arista to develop a Secure AI Data Center solution. The collaboration puts Arista at the center of integrated networking and security for AI infrastructure.

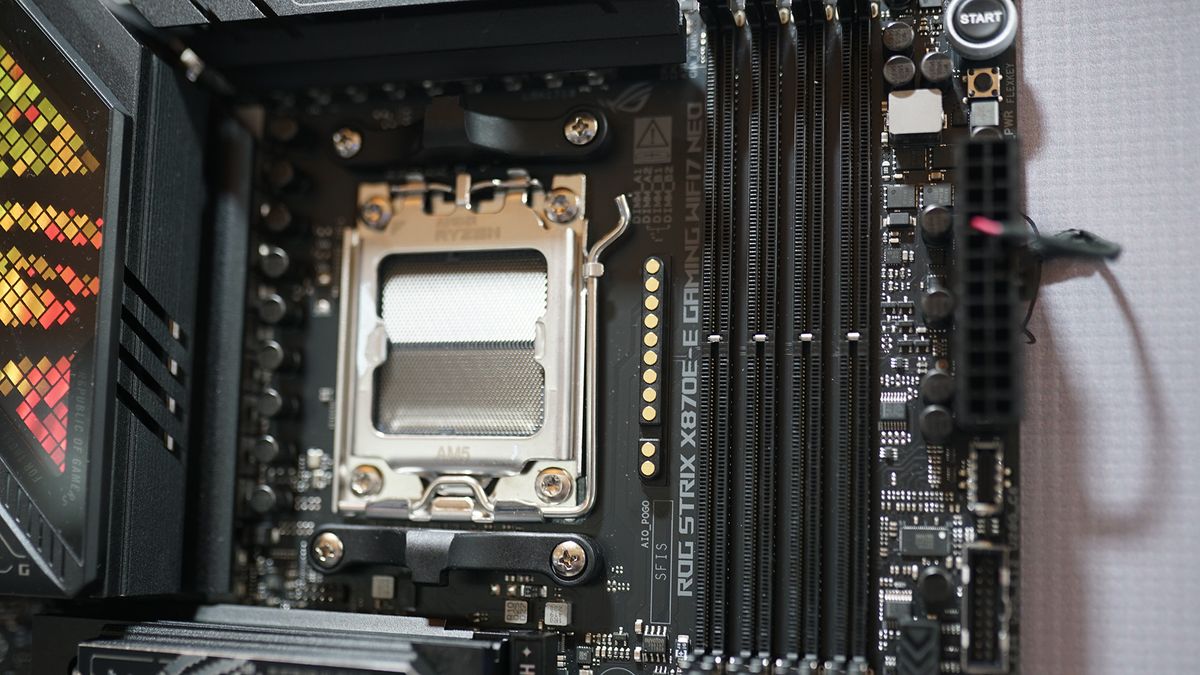

A Zacks Equity Research note released Tuesday focused on Arista’s switch lineup. The report highlighted platforms supporting 400G and 800G Ethernet speeds. These faster connections are becoming standard in modern data centers.

The note mentioned Arista’s ruggedized switches and R4 series. These products target high-speed “leaf-and-spine” architectures used in large-scale data centers. This is the backbone of AI training and cloud computing operations.

The stock surge pushed Arista’s market cap to roughly $183 billion. Its price-to-earnings ratio now sits above 54.

Competitors showed more modest moves. Cisco gained about 2% while Hewlett Packard Enterprise edged up 1%. Arista’s daily swings tend to be larger than the rest of the networking sector.

Customer Concentration Remains a Risk

The company serves as a barometer for AI infrastructure investment. It provides networking equipment for large AI setups, data centers, campus networks, and routing operations.

But a few hyperscale and AI customers drive a big chunk of revenue. If these clients delay upgrades or stretch out orders, the stock could reverse quickly.

Pricing pressure is another concern. Larger competitors continue rolling out new data center gear. Open networking and white box alternatives are also gaining traction.

Investors want to see how fast customers adopt faster network links. They also want to know if Arista can maintain margins while selling more high-end equipment.

What’s Next for Arista

The company’s performance depends on data center build cycles. These typically happen in waves rather than steady progression.

A company webinar on its campus mobility initiative is scheduled for January 22. This could provide updates on product rollouts and customer adoption.

Earnings are expected around February 17 according to Nasdaq’s calendar. Trading volume on Tuesday hit 8.6 million shares, above the 50-day average of 7.7 million.

Analysts project revenue could reach between $13.6 billion and $15.4 billion by 2028. That requires roughly 19.5% yearly revenue growth. Some analysts see a fair value around $163.37, suggesting 26% upside from current levels.

The stock remains 21.23% below its 52-week high of $164.94 reached on October 30.

✨ Limited Time Offer

Get 3 Free Stock Ebooks

Discover top-performing stocks in AI, Crypto, and Technology with expert analysis.

- Top 10 AI Stocks - Leading AI companies

- Top 10 Crypto Stocks - Blockchain leaders

- Top 10 Tech Stocks - Tech giants

.png)

2 days ago

5

2 days ago

5

English (US) ·

English (US) ·