Tom's Hardware Premium Roadmaps

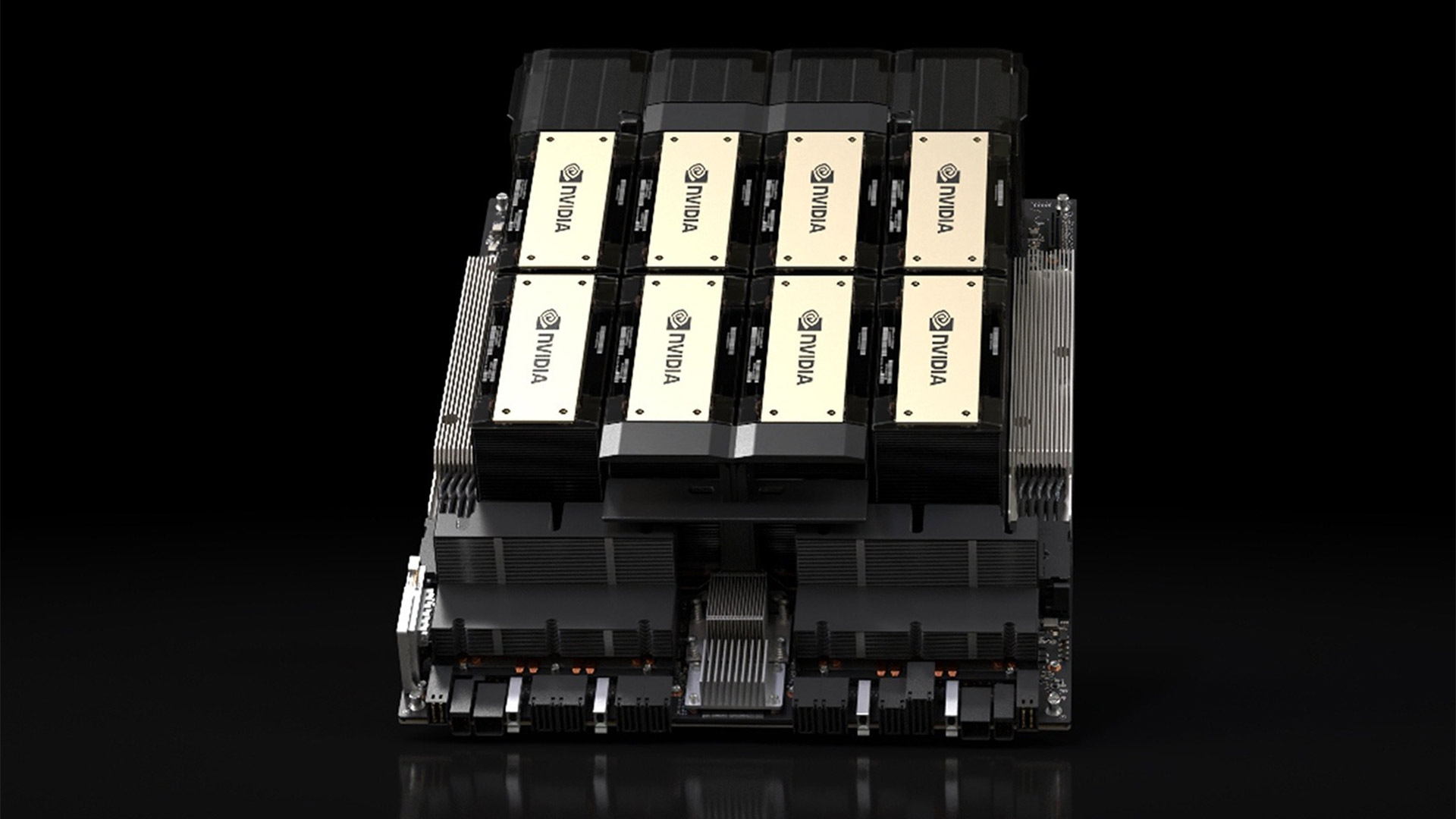

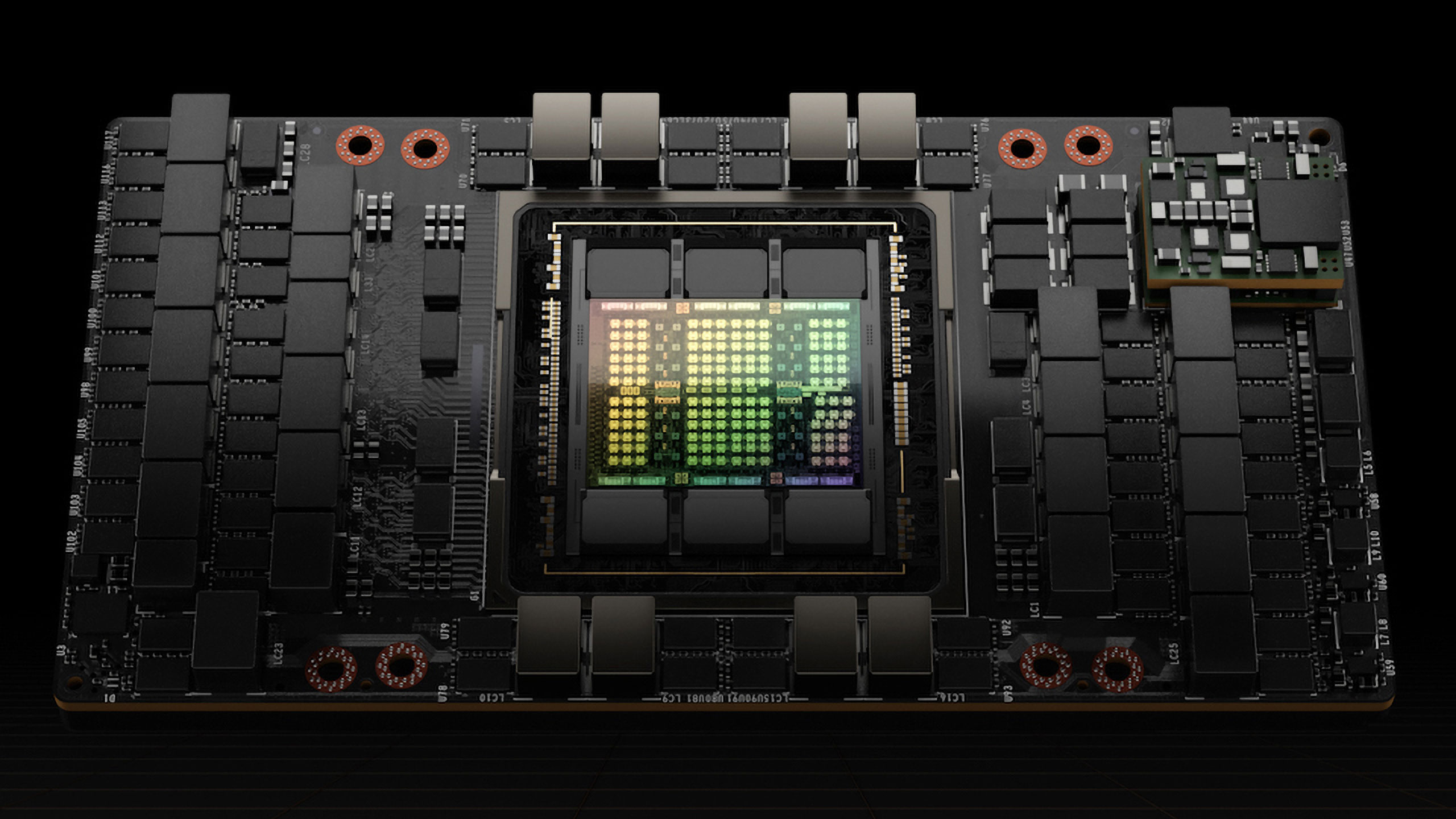

The U.S. Department of Commerce has published new export rules for advanced AI and HPC processors shipped to China and Macau. The new regulations do not open the Chinese market for advanced processors developed in the U.S. in general, but introduce a narrowly defined, compliance-heavy method that allows limited exports of specific products — such as AMD's Instinct MI325X, Nvidia's H200 GPUs, and similar accelerators offering lower performance — under a strict case-by-case licensing regime.

Export rules for two accelerators?

The new rules are designed to enable the export of specific AI accelerators and processors offering similar performance. Therefore, eligible devices must have a total processing performance (TPP) of less than 21,000 and a total DRAM bandwidth of less than 6,500 GB/s.

The policy applies only to end-users physically located in China or Macau, and maintains a presumption of denial for re-exports and countries designated as Group D:5 entities (including Belarus, Iran, North Korea, Russia, and others).

The key constraint is that the U.S. supply must not be disrupted. Exporters must show that U.S. demand is fully met, that no domestic orders are delayed, no U.S. advanced-node foundry capacity is diverted, and that China-bound shipments do not exceed 50% of the same product shipped into the United States.

Essentially, China is now treated as a spillover market for big suppliers like AMD and Nvidia, and is restrictive for smaller companies that might wish to sell to Chinese entities. However, Europe, Japan, and other markets are treated as normal destinations under the new export controls, so the new constraints do not automatically restrict volumes shipped to customers in Europe, Japan, and other nations.

The U.S. DoC's Bureau of Industry and Security (BIS) explicitly references AMD's Instinct MI325X and Nvidia's H200 as examples of products that may qualify, provided they meet TPP (listed dense processing power multiplied by the length of operation) and memory bandwidth limits.

For example, the MI325X has 1,300 TFLOPS of FP16 performance and has a TPP score of 20,800, whereas the H200 offers 989.5 FP16 TFLOPS and therefore has a TPP score of 15,832. As for memory, the MI325X carries 256 GB of HBM3E, with a bandwidth of 6 TB/s, whereas the H200 carries 141 GB with a bandwidth of 4.8 TB/s. As a result, both GPUs meet the requirements of the DoC's BIS and can be shipped to China or Macau, provided that the government grants the license.

Any product exceeding the performance thresholds of 21,000 TPP and 6,500 GB/s of memory bandwidth or any reexport or transfer involving destinations in Country Group D:5, remains subject to a presumption of denial. The same applies to exports to entities headquartered or controlled from D:5 destinations. In other words, if a Russian company wants to resell a batch of H200 processors to customers in China or Europe, the license will be denied.

Testing in the U.S. required

The compliance burden is further complicated by mandatory third-party verification. Every shipment must be reviewed by an independent testing laboratory headquartered in the U.S., with no financial or ownership ties to the exporter or any other party to the transaction.

All testing must be conducted in the U.S. and confirm that the declared specifications — TPP, memory bandwidth, interconnect bandwidth, and copackaged DRAM capacity — are accurate and remain within the stated limits. The BIS can revoke a lab's qualification at any time and suspend case-by-case review for exporters using that lab.

Know Your Customers in the cloud

Another part of the policy is cloud usage controls that the U.S. has been considering for over two years.

From now on, exporters must confirm that the accelerators are not destined for military, military-intelligence, nuclear, missile, or chemical or biological weapons end uses or end users. They must also provide detailed descriptions of "Know Your Customer" (KYC) procedures and physical security measures employed by the receiver. If the hardware will be used in Infrastructure-as-a-Service (IaaS) environments, exporters must disclose all remote end users located or based in restricted jurisdictions and ask the IaaS provider to ensure that no unauthorized remote access is possible. Transfers of model weights or trained algorithms to undisclosed or prohibited users are also explicitly barred.

AMD and Nvidia win, but smaller players lose

While the new export rules enable AMD and Nvidia to supply their MI325X and H200 GPUs to select customers in China or Macau (provided that the Chinese government allows them to buy these processors), the structure of the rule makes large-scale commercial exports hard to conduct.

Furthermore, the new rules specifically restrict shipments of high-performance AI or HPC processors from smaller companies as well as PRC-only SKUs from leading suppliers.

The combination of U.S. supply-first requirements, shipment caps, foundry-capacity protections, third-party testing, and extensive disclosure obligations introduces cost, delay, and uncertainty that will inevitably limit approvals to select units in carefully managed volumes.

On the one hand, this preserves the national security benefits of U.S. leadership in artificial intelligence (which Chinese competitors acknowledge as a challenge), while allowing exports of some products that no longer belong to the leading-edge tier. However, the new restrictions are no longer tied only to performance, but also to the U.S. shipments' history.

For example, if Company A builds Accelerator B that is fully compliant with the U.S. DoC's BIS performance thresholds for China exports, Company A must still sell 50% more Accelerator B units to the U.S. customers than to clients in China. For a small company, this means beating AMD and Nvidia in the U.S. (i.e., by offering a lower price), passing all the obligatory formalities (which are not free), and then selling half of the volumes they sell in America to China, which would be very difficult for many AI startups.

The policy functions less as a reopening of trade with China and more as a controlled way of shipping GPUs to the PRC to preserve the presence of American companies in the country's AI sector and perhaps sell excessive volumes of outdated processors. The new rules enable AMD and Nvidia to seek licenses for older accelerators under strict conditions and ensure that China gains access only to constrained capability after U.S. needs are met. However, it will no longer be possible for companies to sell cut-down China-only SKUs to the PRC without making them available in the USA.

.png)

2 hours ago

1

2 hours ago

1

English (US) ·

English (US) ·