On January 15, Taiwan and the United States of America signed a significant trade deal. On its side, Taiwan earmarked a total of $500 billion for investment in the U.S. semiconductor industry. In exchange, the U.S. dropped its tariff rate on Taiwanese goods from 20% to 15% and allowed for limited duty-free exports for chip companies investing in stateside soil, among other benefits.

The deal has been inked but is pending ratification from the Taiwanese Executive Yuan, and those $500 billion are split between $250 billion in private investment and $250 billion in lines of credit from the Taiwanese government to chipmakers wanting to invest stateside.

Tricky geopolitics

The geopolitics involved are easily described but tricky to navigate: nearby China has long had aspirations to embrace Taiwan into its fold, but North-American companies represent 75% of TSMC's revenue. Plus, it's the only company mass-producing cutting-edge chips for the entire world. This situation is thus described as Taiwan's "silicon shield," and many believe it's the only reason why China hasn't taken over.

As for the United States, the nation has long wanted to curb its nearly exclusive reliance on an external source for advanced chip manufacturing. It's not the only country in this situation; plus, it's never a good idea to have all the eggs in one basket. Many companies are building chip factories outside Taiwan, especially since the COVID crisis illustrated how tightly woven worldwide supply chains are.

The problem is, erecting fabs is an exceedingly time- and money-consuming endeavor. TSMC's Arizona three-fab facility is top-notch, but costs around $55 billion per individual factory. Samsung's Texas fab is going on over $40 billion, and the price tag for Rapidus' Japan build is over $30 billion. All these price tags are significantly higher than those from Taiwan (or South Korea), and it takes multiple years to get just one fab fully set up and ready.

Production still face numerous challenges

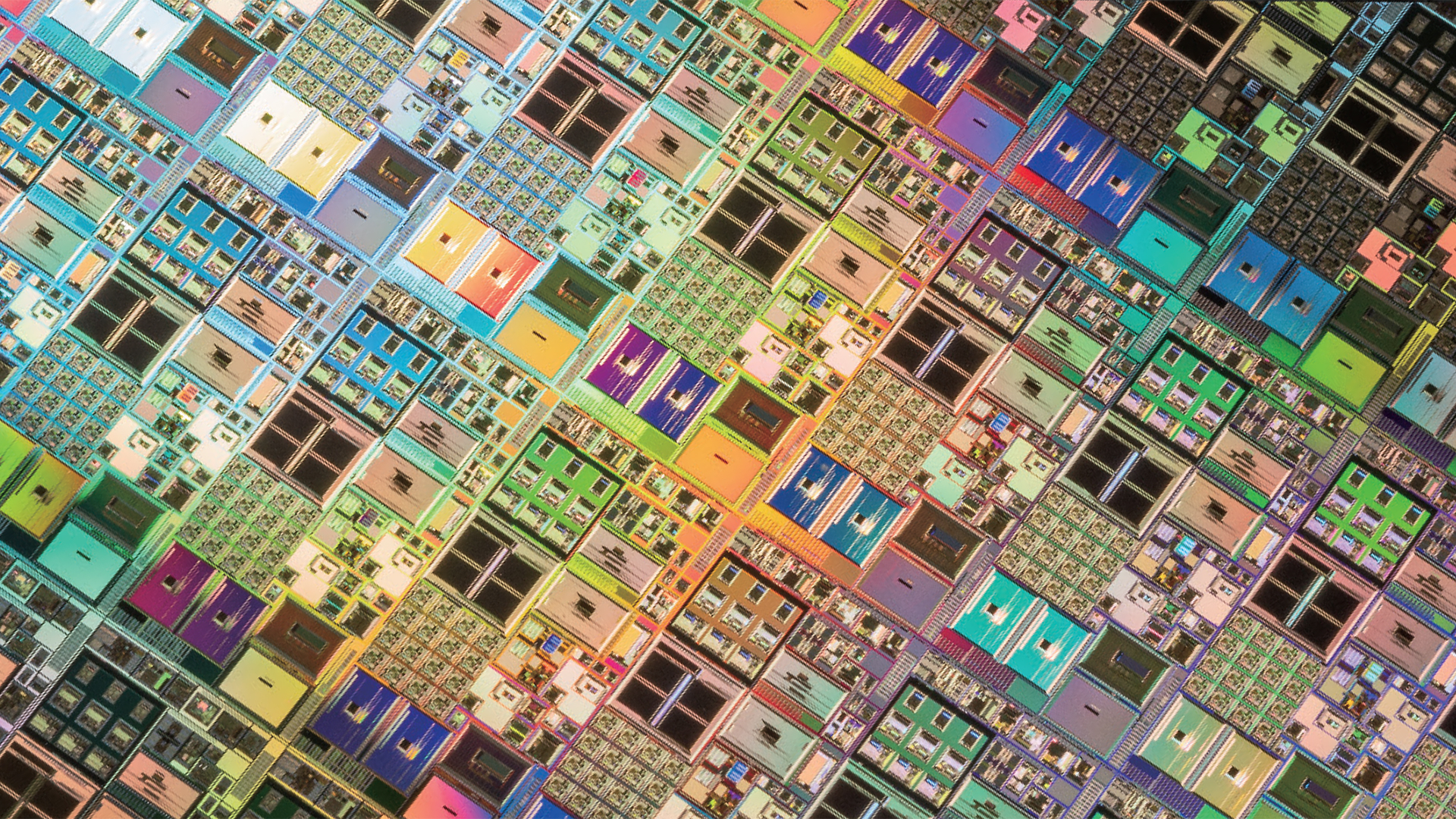

Right now, there are only a handful of locations worldwide actively (or about to start) producing sub-5nm class chips. To briefly sum things up, there's TSMC Arizona, Intel Ireland, and JASM's Kumamoto facility. Samsung's Texas fab will be joining them soon. However, when it comes to making 2nm-class chips outside Taiwan, you can only count on TSMC Arizona.

The AI boom has filled TSMC's coffers to the brim, but as the saying goes, heavy is the head that wears the crown. The company is now worth around $1.7 trillion, and at face value, the trade deal is a boon for both nations and would theoretically strengthen the silicon shield, but there are underlying dangers.

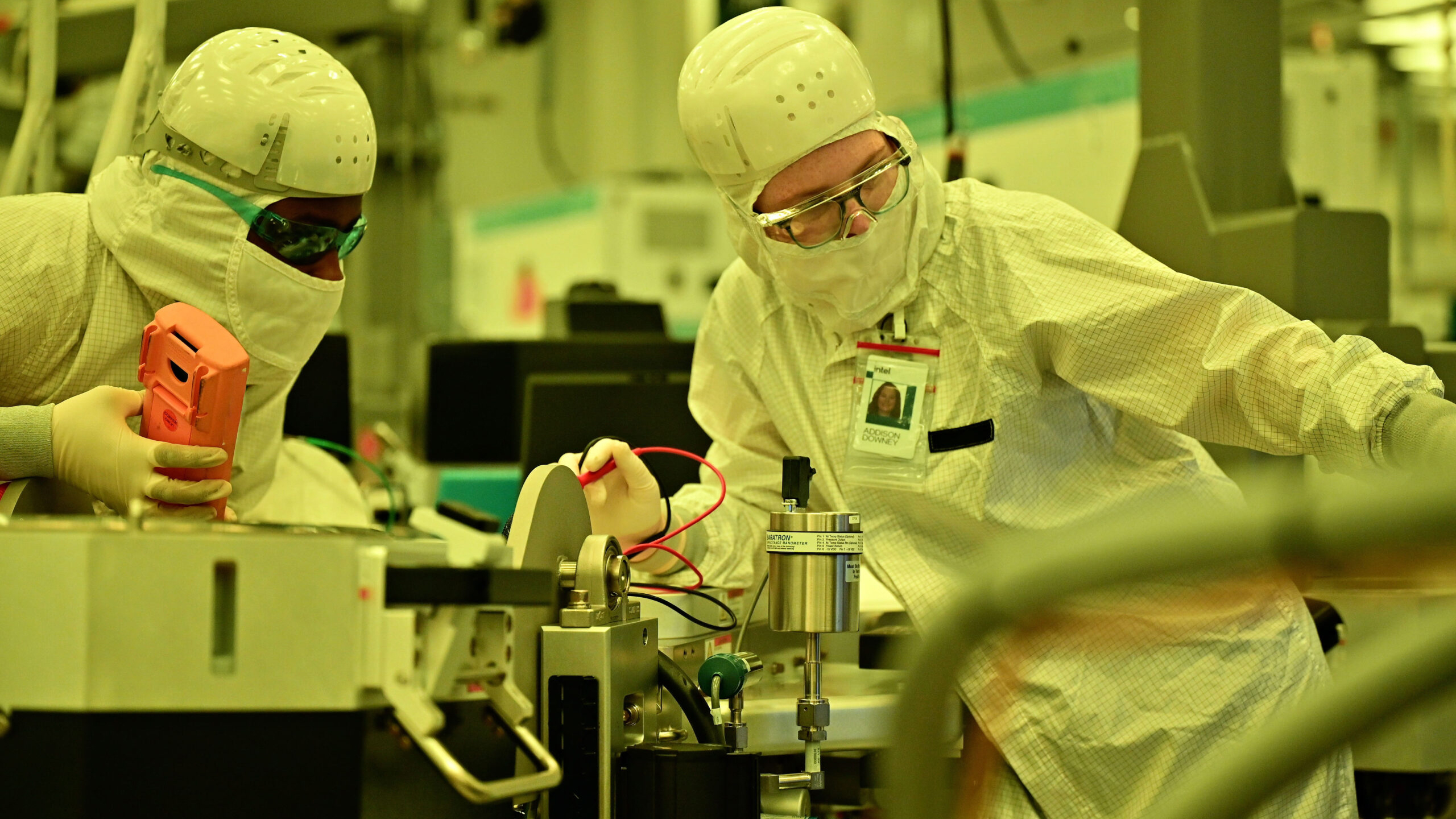

The first concern is that rapid expansion into the United States requires qualified personnel, leading to a potential brain drain, or "hollowing out", of TSMC. The Arizona fab is already home to many Taiwanese engineers, something that TSMC has repeatedly framed as a temporary situation meant to help the local workers get up to speed, but that seemingly turned semi-permanent and presumably made worse by the accelerated build and production schedule.

Brain drain fears

The firm previously stated that there were "insufficient skilled workers" in the region, and the Taiwanese culture of 12-hour shifts and rigid structure clashed with U.S. labor laws, and only exacerbated the shortage. Illustrating the situation, last November, 137,000 Taiwanese citizens were working in the U.S., with the increase in that figure mostly attributed to TSMC's expansion.

Both TSMC and Taiwan government representatives have repeatedly assuaged worries about the brain drain, stating that the most advanced R&D will remain in the home base. However, the U.S. administration wishes to manufacture precisely the highest-grade chips in its soil, and is reportedly offering assistance to Taiwan for "acquiring resources such as land, water, electricity, infrastructure, tax incentives and visa programs", further enticing staff exports.

Pure chip production cost is also a factor. Labor is far more expensive in the U.S. than in Taiwan, so high-end chips made there are expected to be substantially pricier than usual. This would eat into TSMC's profit margin, and/or require big shoppers like Nvidia and Apple to be willing to pay premium prices for the same goods, risking the investment. There's a fair chance that further U.S. government intervention could help remedy this, though, as the Trump administration can't help but keep twiddling the tariff knobs everywhere.

On that note, Washington's desire to essentially reshore 40% of advanced chip production is seen by many as unrealistic. Just today, Nvidia CEO Jensen Huang arrived in Taiwan and tried offering some clarification, saying that that 40% slice is meant to be taken from new chip production. He further believes that TSMC must expand beyond Taiwan to meet current needs, remarking on Taiwan's energy capabilities as one key limitation factor.

Even still, those statements appear to be at odds with those of the opposite corner, with Economics Minister Kung Ming-hsin saying that Taipei wants to keep 85% of advanced chip production capacity by 2030, a split set to increase to 80%/20% by 2036.

Moreover, since the deal has yet to be ratified by the opposition-controlled Taiwan Executive Yuan. Unsurprisingly, said opposition has been fierce in criticizing the arrangement. Several members pointed out that the government made the deal under duress of tariffs, without properly consulting all the parties, and offering insufficient info. The main opposition party, Kuomintang (KMT), called for a full legislative review of the agreement on the day after it was signed.

Opponents also remarked that Taiwan would effectively use its own money to fund U.S. investments, and that the negotiation itself was poor, as Taipei only got the same 15% general tariff reduction as other countries while offering up its most precious strategic commodity. Some could counter-argue that the duty-free chip exports could be more valuable overall, however.

TSMC and Taiwan are definitely living in interesting times, and we'll be sure to hear a lot more about this trade deal in the coming weeks. It'll be exceedingly difficult for Taiwan to keep its huge customers happy, thus keeping the silicon shield powered, without losing a technological edge to its competitors, nor moving its best goods out of the country. Either of those would turn off the shield regardless. It's definitely a balancing act on a tightrope.

.png)

3 hours ago

1

3 hours ago

1

English (US) ·

English (US) ·