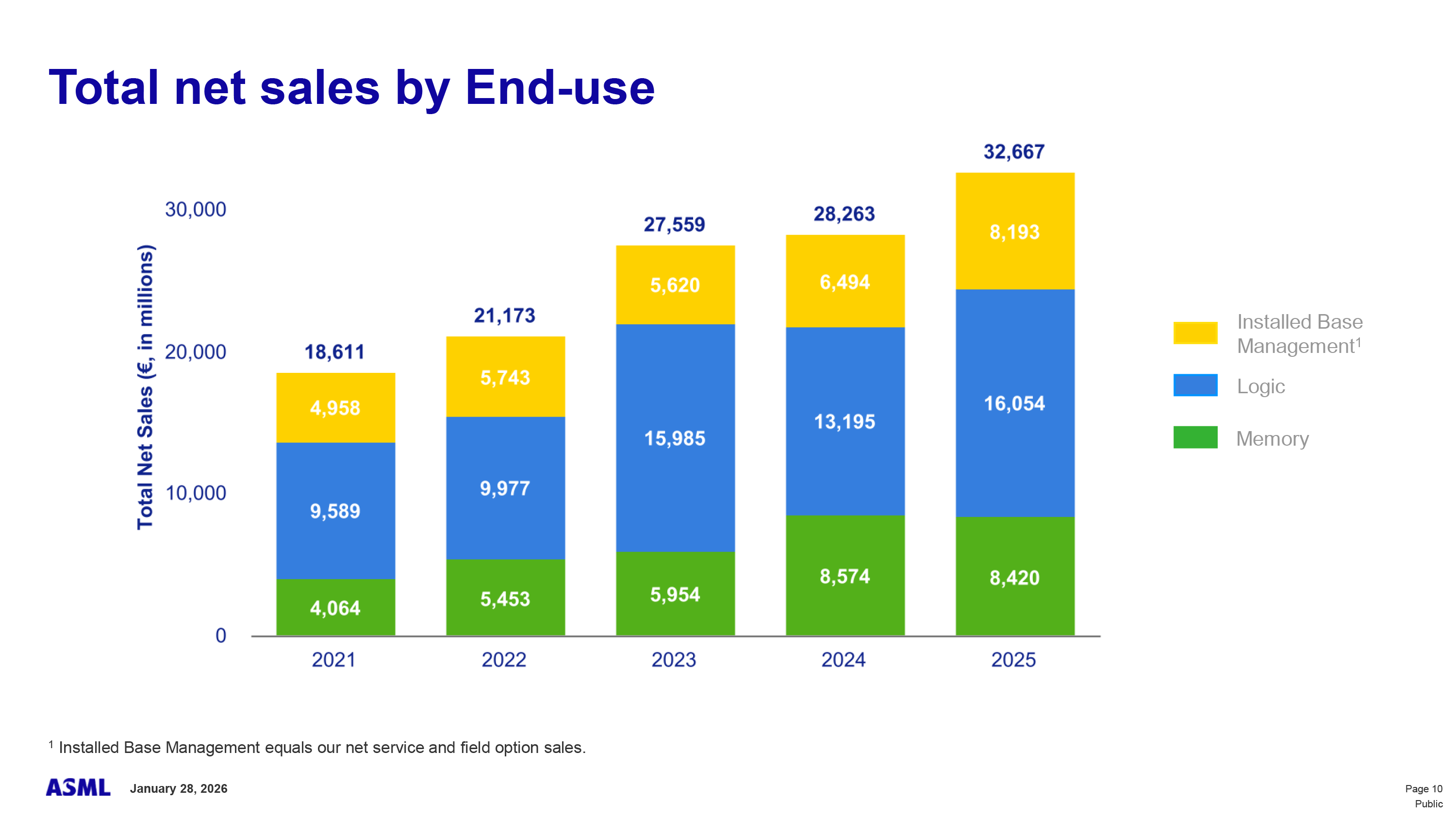

ASML this week posted its highest yearly result ever as demand for its chipmaking tools set records. The company's revenue for the fiscal year 2025 totaled €32.7 billion ($39 billion USD), up 15% from the previous year. As expected, sales of lithography and other wafer fab equipment to China-based entities decreased in 2025 due to export rules imposed by the U.S. and the Netherlands. When it comes to sales of lithography systems, EUV tools became the leading source of ASML's revenue.

Fewer sales in China

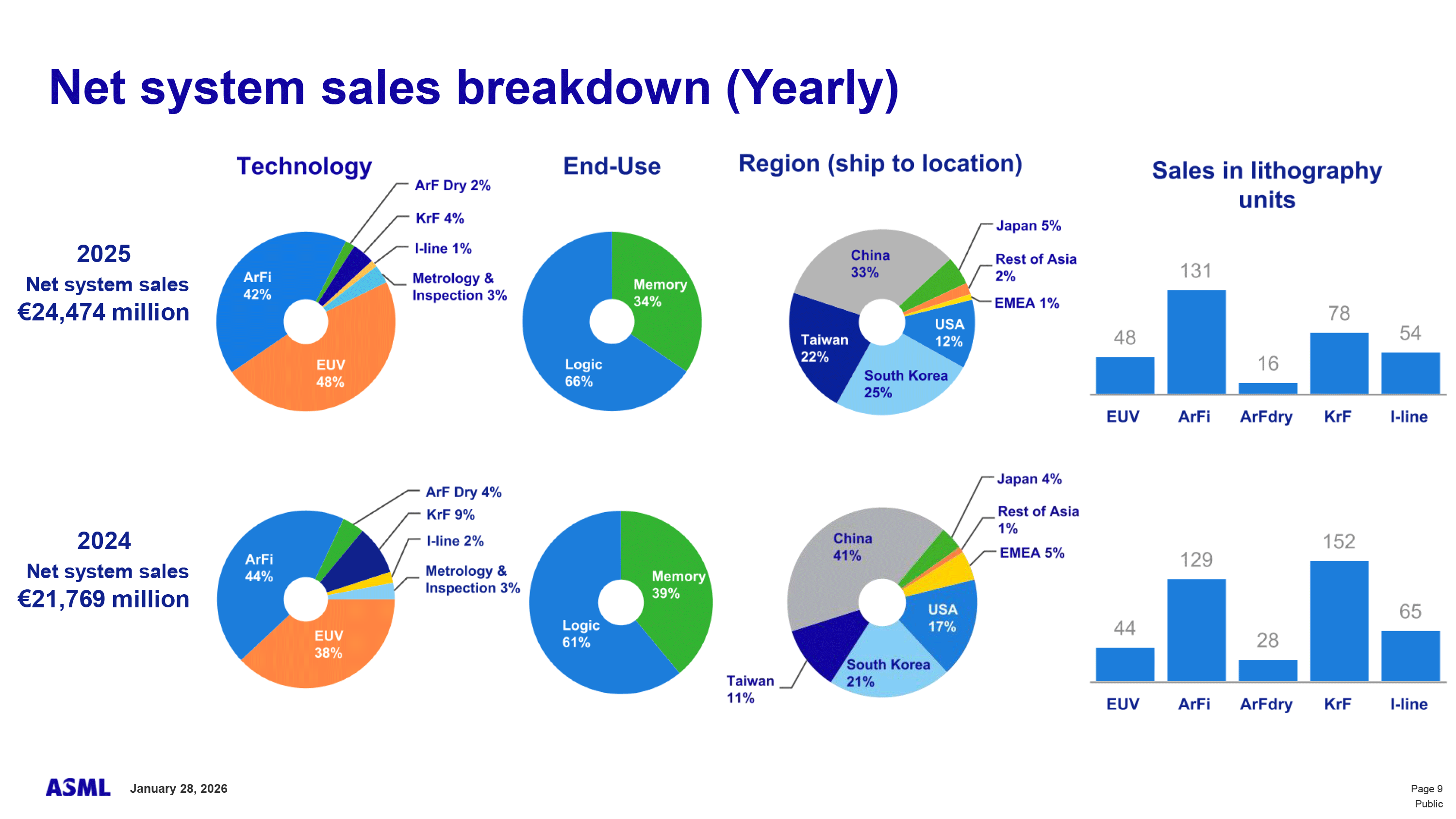

China is followed by sales of wafer fab equipment to customers in South Korea (25%) and Taiwan (22%). By contrast, only 12% of ASML-produced tools (by unit count) were shipped to the U.S.

High-end EUV

U.S.-based Intel bought the world's first High-NA EUV Twinscan EXE:5200B lithography tool with 0.55 numerical aperture optics, designed for mass production of chips using next-generation process technologies, such as Intel's 14A (1.4nm-class). Another system was assembled at SK hynix's fab M16 in Icheon, South Korea. Meanwhile, ASML has supplied eight High-NA EUV tools (including six EXE:5000 and two EXE:5200B machines) to additional partners so far.

Speaking of EUV lithography systems, it's important to note that both current-generation Low-NA EUV scanners and next-generation High-NA EUV machines accounted for 48% of ASML's system revenue in 2025 (or €11.6 billion / $13.8 billion USD), up from 38% a year earlier. For the whole year, the company shipped 48 EUV systems and 131 immersion DUV tools, up from 44 EUV scanners and 129 immersion DUV machines in 2024.

Sales of EUV and sophisticated DUV tools are primarily driven by leading-edge logic fabs that build chips for AI infrastructure as well as smartphones and PCs. In fact, logic fabs accounted for 66% of ASML's system sales, whereas memory accounted for 34%. Although both logic and memory makers strive to increase their output and procure new tools, logic producers buy more expensive EUV systems.

"In advanced Logic, our foundry customers have become more positive on the long-term sustainability of demand on a number of fronts," said Fouquet. "AI accelerators are migrating from the 4nm node to the more litho-intensive 3nm node. At the same time, customers continue to ramp the 2nm node in support of next-generation HPC and mobile applications."

However, as DRAM vendors adopt more sophisticated fabrication processes that rely on EUV, they will also intensify procuring EUV scanners, which will significantly increase demand for this type of equipment as memory makers tend to operate very large fleets to fab commodity products in the most cost-efficient way.

"In memory, our customers are reporting very strong demand for both HBM and DDR products with supply remaining very tight through at least 2026 as they ramp both their 1b and 1c nodes in support of the demand," Fouquet added. "In addition, DRAM customers continue to adopt more EUV layers on these nodes. This is expected to continue on their future nodes as they migrate more multi-patterning DUV to single-exposure EUV, resulting in an increase in litho intensity."

Record results

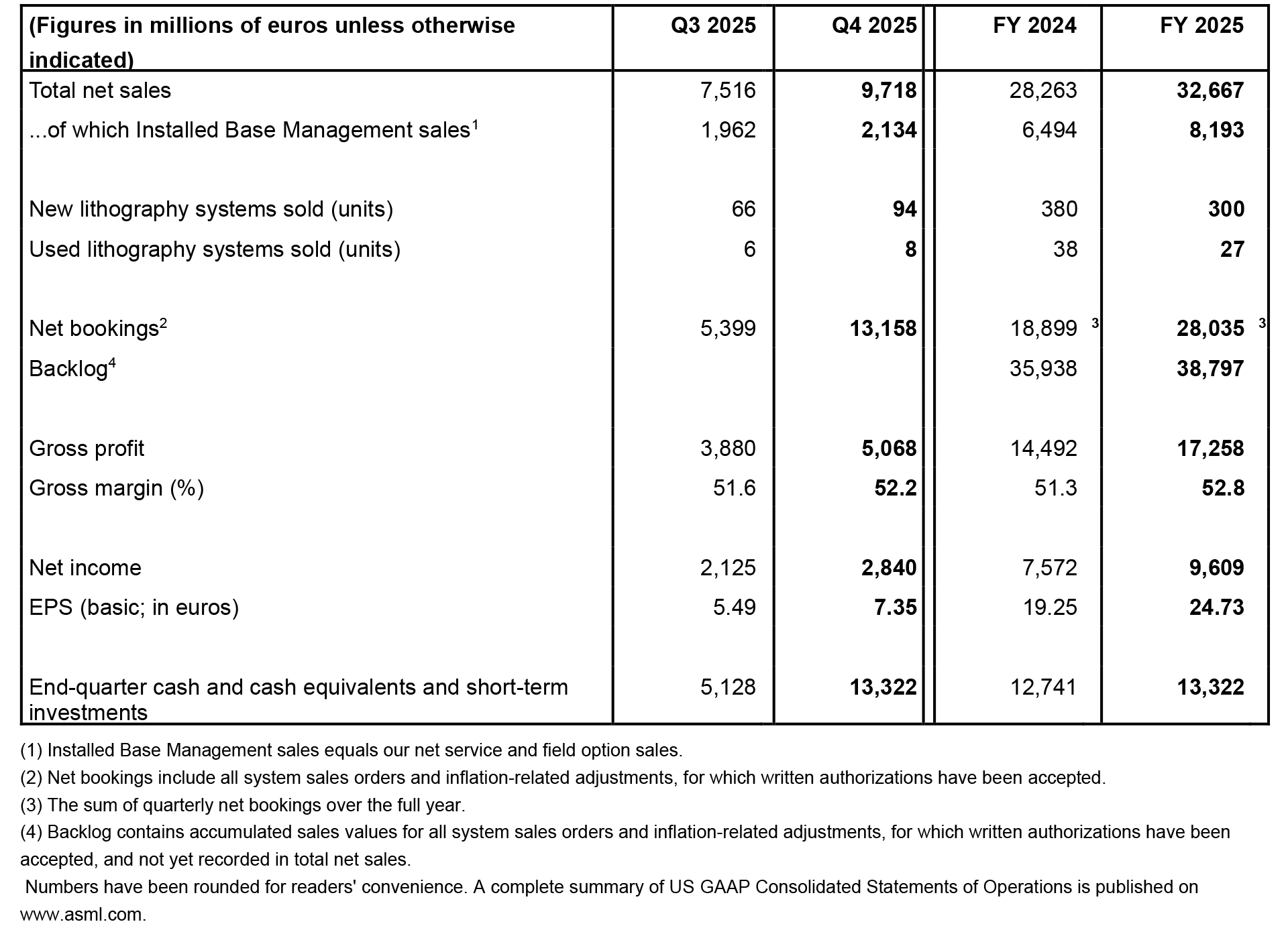

ASML closed 2025 with a record fourth quarter and its strongest year ever. In Q4 2025, the company's revenue totaled €9.7 billion ($11.5 billion USD), its gross margin reached 52.2%, and net income hit €2.8 billion ($3.3 billion USD).

For the full year, the company generated €32.7 billion ($39 billion USD) in net sales, up from €28.3 billion ($33.8 billion USD) in 2024, with a 52.8% gross margin and €9.6 billion ($11.4 billion) in net income.

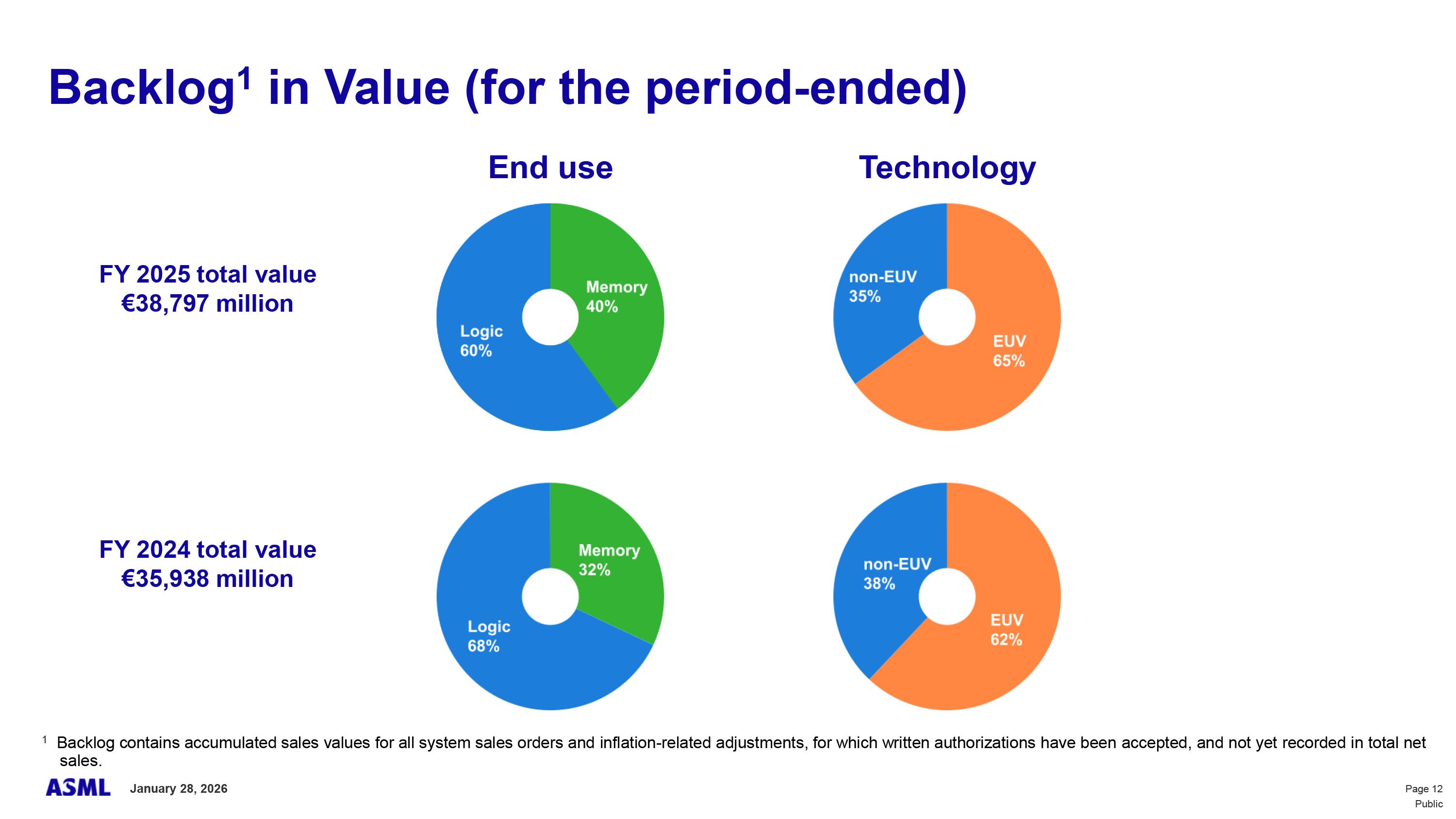

ASML's net bookings reached €28.0 billion ($33.4 billion USD), whereas their year-end backlog grew to €38.8 billion ($46.3 billion USD), another record for the company.

During the final quarter of 2025, the company supplied 94 new photolithography systems as well as eight used lithography machines. For the whole year, ASML sold 300 new lithography tools and 27 used lithography systems.

For the first quarter of 2026, ASML expects revenue of €8.2 billion – €8.9 billion ($9.7 - $10.6 billion USD), which is up year-over-year but down sequentially. Full-year 2026 revenue is projected to be between €34 billion and €39 billion ($40 billion - 46 billion USD), this reflects growing demand for lithography tools and EUV scanners, primarily due to the wide AI infrastructure buildout. Gross margins at ASML are projected to be between 51% and 53%.

"In the last months, many of our customers have shared a notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand," said Christophe Fouquet, chief executive of ASML. "This is reflected in a marked step-up in their medium-term capacity plans and in our record order intake. Therefore, we expect 2026 to be another growth year for ASML's business, largely driven by a significant increase in EUV sales and growth in our installed base business sales. We continue to invest in people and footprint to support that growth in 2026 and beyond."

Looking ahead

Being the only supplier of EUV and advanced DUV tools on the planet, ASML has every reason to expect sales of these scanners to increase in the coming years. The number of EUV layers increases with the upcoming process technologies, driving its revenue all the way to €44 billion - €60 billion ($52 billion - 71 billion USD) in 2030. Indeed, EUV tools accounted for 65% of ASML's backlog in late 2025, up from 62% a year before. If the demand for their tools continues apace, then ASML will be sitting as one of the most important companies in the ongoing AI boom, right alongside Nvidia.

.png)

2 hours ago

1

2 hours ago

1

English (US) ·

English (US) ·